“We’ll make you big money by renting your backyard, and it won’t cost you a dime!” So advertise backyard lease, development, and property management companies in the process of aggregating an ADU portfolio. Promoted as a solution to California’s affordable housing crisis, new ADU regulations are yet another sleazy housing industry scheme to make huge profits for themselves and wealthy Wall Street investors at the expense of the average homeowner.

Under new rules effective January 1, 2020 regulating the creation of ADUs, every California property owner has been set loose to conduct commercial activity by monetizing their backyards. Fast-moving companies with the scent of profit in their noses are already hawking their services, with promises of a steady income-stream for property owners. Facebook ads by such companies are already running across my newsfeed. A new gold rush has begun, but this time it’s the gold buried in California’s backyards. Wall Street is salivating; let me tell you why.

It costs between $50,000-150,000 to convert a garage to an ADU, and as much as $400,000 to build a 1,000 square-foot ADU from scratch. Aside from the occasional single property owner who might have the credit or cash to finance this amount, attention is going to corporations who can bundle this new type of real estate asset and monetize the business model by issuing stocks and bonds. This means banks, mortgage issuers, insurance companies, finance companies, tax accountants, and yes, most certainly Wall Street, are going to be involved.

What of pre-existing density and zoning rules? With the new statewide ADU regulations, every single-family-zoned property in California with a yard has suddenly been converted to multiple-family zoning. ADU homes of 800-1000 square feet are big enough for a couple, and even a couple with kids. This alone will cause a geometrical, unplanned density increase of cars and people in most neighborhoods; new neighbors on every side is a real possibility.

Roughly half of the residential real estate in America is investor-owned, not home-owner occupied, and California’s new ADU regulations eliminate owner-occupied requirements. Accordingly, it’s wealthy property-owner-investors and sophisticated housing development corporations and their allies who will harvest the money-tree now bearing fruit in California’s back yards; then again, it never hurts to appeal to good-old American greed. Every home-owning Californian is now being cultivated as a budding business-entrepreneur-landlord, with a valuable nest egg sitting in the backyard, legally entitled for rapid exploitation. California’s new ADU rules demand a streamlined application approval process, the swiftest in the real estate development industry, so the ready money is lining up. But there’s a host of other issues and questions.

Will an ADU be affordable to rent? Real estate development and property management companies are interested in maximizing profits, not affordability. Government regulations mandating the affordability of ADUs are not allowed, and they will rent at the highest price the market will allow. Property taxes associated with ADU construction will have to be folded into rental rates; a $400,000 ADU will add $4,000 a year in taxes, plus increased homeowner insurance. And who will rent these ADUs in Sonoma? Will wealthy, white homeowners seek low-paid Latino restaurant or hotel workers as tenants? Not likely, but well-paid high-tech workers in the Bay Area will be delighted to rent a small house in Sonoma to enjoy on the weekends.

Development impact fees are not collected on ADUs under 750 square feet. This means government will see little in the way of new revenues while at the same time must provide services to a larger population of residents. Does an ADU have its own address, for like mail delivery? What about utilities, like PG&E and garbage? It will get complicated.

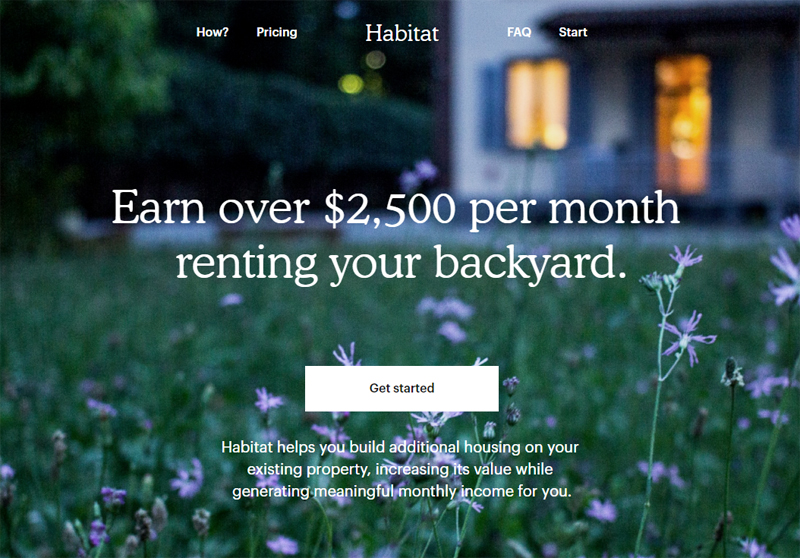

Being a landlord can be a real pain, which is why the business world is salivating, knowing they will grab most of the profits through ADU property-management corporations that find tenants, and manage rent collection. And corporations seek to maximize profits, so rent will always be market-rate. A 1,000 square feet unit is large enough for two decent-sized bedrooms, a livingroom/kitchenette and bath, and will rent in Sonoma for at least $2,500/month; that’s more than a full month’s take-home pay for a worker with a minimum-wage job.

Sound travels and sometimes a noisy neighbor over the fence can be a challenge; having four new neighbors added to the ones you already have will certainly be interesting, particularly if it’s multiple families.

Setbacks and zoning requirements have traditionally been applied to the development of neighborhoods of single-family housing through the imposition of minimum lot sizes required for dwelling units, formulas about lot coverage, and floor/area ratios. Growth management ordinances have regulated the rate of development and population increase. Historically, the population in Sonoma has increased at a managed average rate of 1% per year. If only 20% of the 4,500 single family parcels in Sonoma build and rent an ADU in the next few years, the population will quickly increase by a whopping 20%. The same goes for the rest of Sonoma Valley; do the math.

We’ve seen this game before; the market will quickly be oversaturated with ADUs sitting empty, and unwitting homeowners unable to keep up with payments associated with ADU costs will lose their homes. It’s just another version of the type of housing bubble that collapsed in 2008.

Past regulations created single-family neighborhoods as we’ve known them, forming the basic fabric of the community; the new ADU regulations will change all that. Under the guise of a housing crisis, Sonoma and the rest of California has been snookered by an avaricious building industry into the uncharted territory of yet another real estate boom and bust.